August 18, 2025

Artificial intelligence (AI) continues to evolve and expand, and with that surge in innovation, the power needed to run the data centers supporting AI and other digital technologies is growing exponentially. New facilities are coming online at a rapid pace and companies are looking to alleviate concerns about environmental impacts and increased power demands straining and draining the electric grid. Checking both boxes, fuel cells have a proven track record as an efficient, reliable, and scalable power solution for data centers.

A December 2024 report from the U.S. Department of Energy (DOE), 2024 Report on U.S. Data Center Energy Use, states that in the U.S., data centers consumed about 4.4% of total electricity consumption from data centers is expected to grow more than 2% by 2028, from 4.4% in 2023, at 176 terra-watt hours (TWh), to ~6.7 to 12% (325-580 TWh) by 2028.

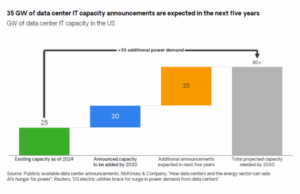

Other recent studies, while each looking through a different lens, predict a rapid rise in data center power demand and consumption.

S&P Global, in its US National Power Demand Study projects electricity demand to surge 35-50% by 2040, driven in part, by data centers. The International Energy Agency (IEA), in Energy and AI, predicts that electricity demand for data centers will more than double by 2030 to ~945 TWh by 2030, with the U.S. projected to consume the largest share of this increase.

Goldman Sachs forecasts global power demand from data centers will increase 50% by 2027 and by as much as 165% by the end of the decade in Generational Growth AI, Data Centers and the Coming US Power Demand Surge. That report also projects that AI will grow from 14% to 27% of the overall power demand market.

Goldman Sachs also estimates that bolstering the electric grid to support that need will require a significant investment, around $720 billion through 2030. In lieu of waiting for these investments and grid developments, companies are looking at distributed generation and onsite power solutions like fuel cells to solve these problems.

Source: Goldman Sachs

As outlined in a previous blog post, Data Centers: More Power, More Fuel Cells, fuel cells have provided high-quality, reliable backup or primary power to data centers, banks, and other critical facilities for decades, with a long and impressive list of technology customers.

To recap, fuel cells are fuel flexible, with most utilizing domestically produced natural gas or other low- to -zero-carbon fuels and feedstocks. Systems operate quietly and are scalable as needs require. Fuel cells are inherently efficient and capturing the byproduct heat and water to use to cool the data center servers, increases that efficiency. Data centers require a lot of water, and fuel cells help mitigate that need, as most operate close to or in water balance.

The Fuel Cell & Hydrogen Energy Association (FCHEA) has many members involved in this sector, and there has been a lot of significant activity since that blog post.

Bloom Energy has been deploying fuel cells for data centers and other critical facilities around the country for many years now. The company conducted its own study on data centers, releasing the 2025 Data Center Power Report in January, and a mid-year update in June. The results reinforce the opportunity for fuel cells as it shows the importance of power access to facility operators and increase in utilizing onsite power to support larger AI-driven data centers.

Adding on to the reported partnerships in the last blog post, Bloom has announced more than 1 gigawatt (GW) of orders and agreements with new and existing technology customers to support data centers and AI cloud solutions in the U.S.

In November of last year, Bloom signed a supply agreement with American Electric Power (AEP) for up to 1 gigawatt (GW) of fuel cells, starting with a 100 MW order to help power AI data centers.

In February, the company announced a major expansion to its existing partnership with Equinix, bringing electricity capacity to more than 100 MW to support Equinix’s International Business Exchange™ (IBX®) data centers across the country.

Also an early innovator in this sector, Renewable Innovations worked with the National Renewable Energy Laboratory (NREL) in 2017 to prove the feasibility and value of fuel cells powering a data center, then working with Microsoft and others to show scalability. The company’s EmPower fuel cell modules use hydrogen to provide uninterruptible power to data servers, replacing loud, smoky, and unreliable diesel generators.

Source: Renewable Innovations

FuelCell Energy recently announced a strategic partnership with Diversified Energy and TESIAC to create an Acquisition and Development Company (ADC) to supply as much as 360 MW of electricity to data centers located in Virginia, West Virginia, and Kentucky. The ADC will be focused on leverage in-basin natural gas production to fuel the fuel cell systems with natural gas and captured coal mine methane to power data centers.

Baker Hughes sees opportunities for its gas turbine technology to support data center growth. The company announced an award from TURBINE-X Energy Inc. for its NovaLT™ gas turbine technology that will be deployed at multiple data center projects across North America. Baker Hughes is also partnering with Frontier Infrastructure to integrate its NovaLT™ turbines as part of a 256 MW power generation project that will supply to data centers in the Western part of the U.S., including Wyoming and Texas.

As AI drives larger and more power-intensive data centers, it is increasing the need for efficient, scalable, and onsite power solutions. FCHEA members have a portfolio of commercially available customer-tested and verified products. Fuel cells and hydrogen-capable turbines are already helping meet the AI challenge with the added benefits of utilizing domestic sources and technologies to produce clean, reliable energy. It doesn’t get more intelligent than that.

Check out FCHEA’s Fuel Cells for Data Centers fact sheet and to keep on top of the latest fuel cell and hydrogen news, subscribe to FCHEA’s free monthly Connections newsletter.